While the US-China tariff pause signals a temporary détente, the realignment of global supply chains and consumer-brand relations is well underway. We outline key strategies for both brands and suppliers as consumers skip the middleman and look directly to the source

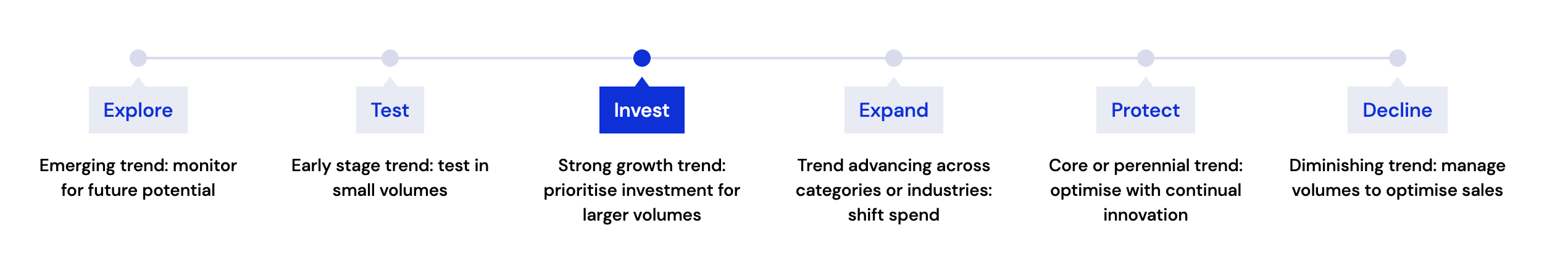

Trend Investment Projection

Need to know

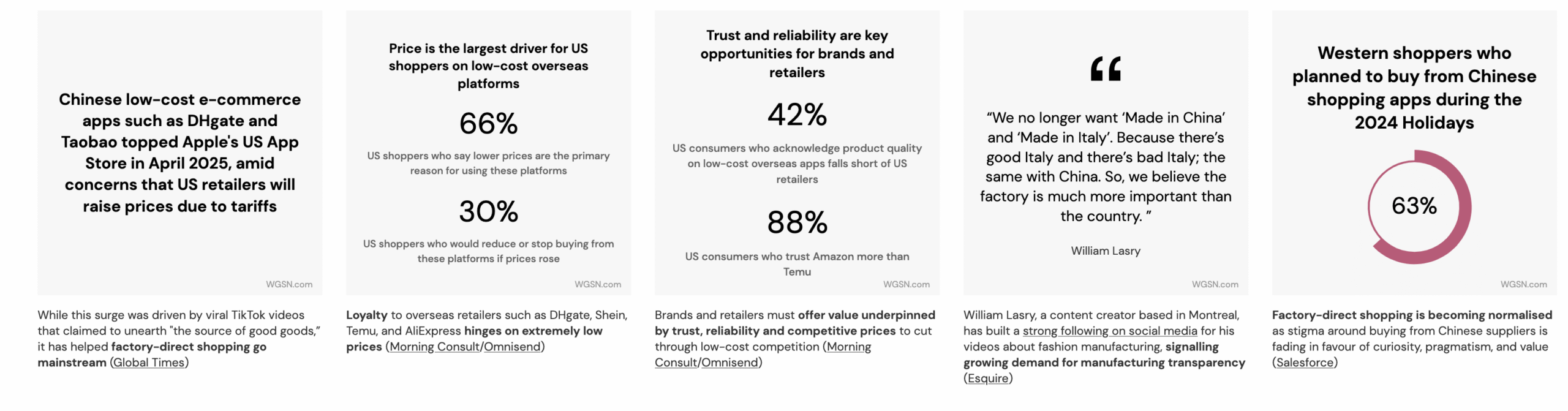

While the US and China have announced a 90-day pause on reciprocal tariffs, the supplier-to-consumer trend, set off by the initial wave of tariffs, has fundamentally upended consumer mindsets around quality, value and brand prestige.

Opportunity

Amid the upheaval resulting from tariffs, consumer brands must reassert their relevance by demystifying production, strengthening original equipment manufacturer (OEM) and original design manufacturer (ODM) relationships, and leaning into niche, emotionally resonant brand worlds. Destigmatised dupe culture, which is shifting power away from brands and designers to manufacturers, is also meeting rising OEM visibility to sow new doubt around brand value among shoppers. To maintain consumer trust and pricing power, brands must reframe their role not just as product sellers but as educators and curators of quality, origin and innovation. Ultimately, leveraging OEM and ODM partnerships in this era means finding synergy where possible and drawing hard lines where necessary.

Meanwhile, suppliers now have the unique opportunity to go from factory to front stage, building direct-to-consumer offerings that centre on quality, craft and cultural credibility. The bar to converting shoppers is falling, as consumers normalize factory-direct shopping and take a proactive approach to seeking out the source of their products. As value-conscious consumers grow more comfortable buying directly from suppliers, the edge belongs to those that embrace transparency, develop

storytelling fluency and build trust on both sides of the chain. Success will hinge on the ability for suppliers to turn the impersonal image of ‘factory in Asia’ into a friendly, engaging shopping experience for global consumers.

Key strategies

Brand strategies:

- Demystify your process: invest in creating and communicating supply chain transparency and turn it into a competitive advantage

- Craft and commit to your niche: niche doesn’t mean small; it means focused. Home in on key aesthetics, values, icons and brand worlds that can’t be easily replicated

- Protect OEM relationships: invest in meaningful collaboration and safeguarding brand IPs

- Supplier strategies:

- Start selling on socials: offload excess stock in the short term and explore new revenue streams by going direct-to-consumer (DTC) on social channels

- Reframe ‘made in Asia’: be proud of your manufacturing heritage and convey that ‘Made in Asia’ means “made by experts using world-class tech”

- Nurture trust with brands: maintain trust and goodwill with partner brands, even as you potentially compete with them in the market

Proof points

Brand strategy: demystify your process

Consumers are demanding transparency, so meet them where they scroll. Turn your supply chain into part of your brand story, showcasing authenticity, quality and integrity.

Strategies

- Work with your manufacturers to invite customers behind the curtain. Regularly share “making of” content – factory floor tours, artisan interviews, quality tests – on Instagram, TikTok, and YouTube to build trust and credibility

- Demystification shouldn’t be one-way, and brands should host interactive, live Q&A sessions that address customer concerns and questions. Do a livestream from your production site if possible, which will help consumers feel like insiders while still providing control over your brand’s narrative

- Highlight makers and materials. Put a human face on your supply chain by featuring the people and components behind your product and introducing the master leatherworker, the expert perfumer or the family-run workshop that contributes to your goods

- Turn transparency into a competitive advantage. Share the breakdown of production costs or sustainability metrics of your products to help savvy shoppers justify price mark-ups

- Embrace the fact that luxury is about intention, not geography. While legacy brands have long been reluctant to use Asian manufacturing, consumers today reward brands for transparency and honesty. Highlight how your production reflects your brand’s values: for instance, if you moved production to Vietnam or Portugal for better expertise or sustainability, say so

London-based independent fashion label Odd Muse openly touts that it manufactures in China under strict quality control, framing it as a conscious choice rather than a compromise. Founder Aimee Smale found Chinese factories “simply the best for the quality” she wanted, turning unapologetic transparency into a brand asset

In action

While consumer tech giant Apple was secretive about its assembly lines in China decades ago, the brand now emphasises the rigorous standards those facilities uphold. Following this ethos, brands can redefine “Made in ____” as a mark of quality processes rather than just locale

Taking a proactive approach to production transparency, Spanish fashion label Desigual utilises third-party audits and publicly discloses its Tier 1 suppliers, many of which are based in China and India

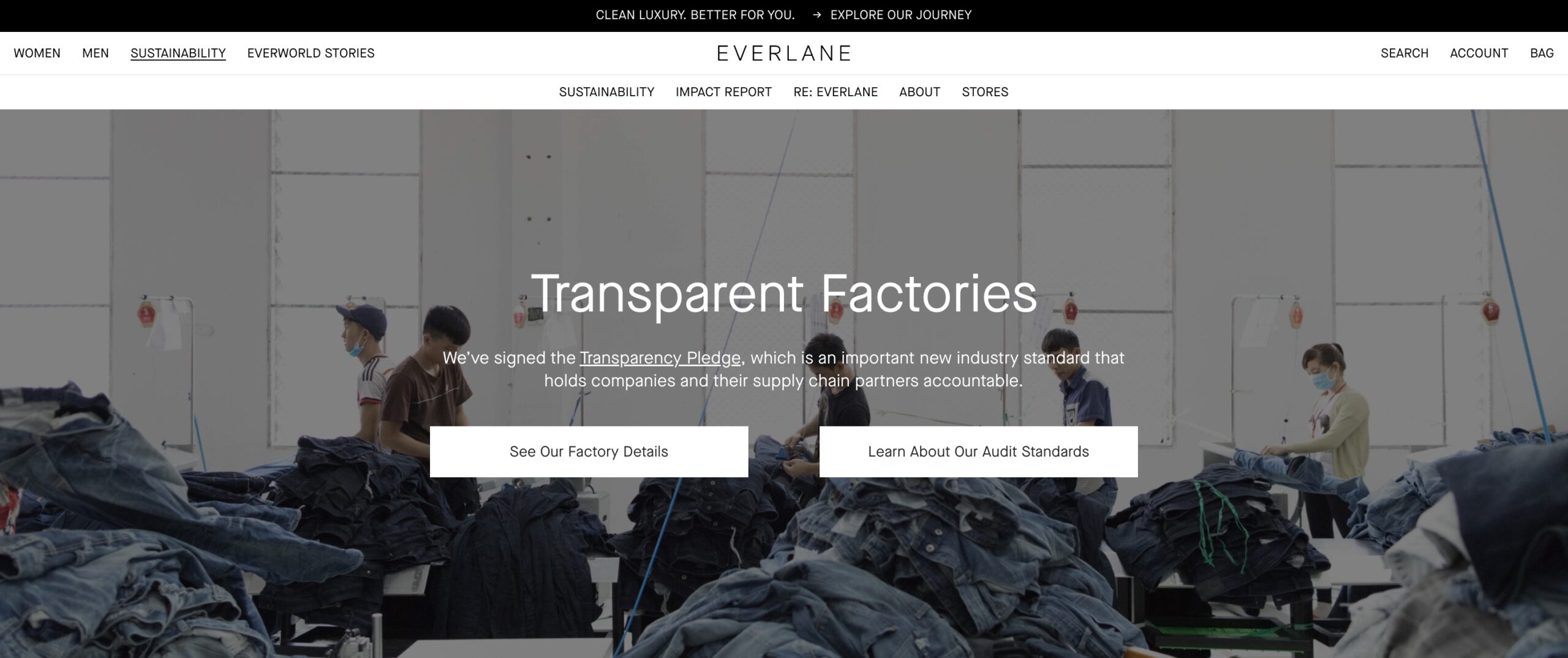

A pioneer in radical accountability, American retailer Everlane communicates its commitment to the transparent pledge, publishes cost breakdowns for each product and publicly shares factory information on its site

As part of its travelling Hermès in the Making exhibition, the brand spotlights French artisans, including safflers, leatherworkers, porcelain painters and jewellers, in interactive live showcases

Brand strategy: protect OEM relationships

Rather than treating suppliers as potential competitors or interchangeable cogs, view them as strategic partners and co-creators that help you protect your IP and guarantee product differentiation.

Strategies

- In this new landscape, assume that if you don’t protect your product, it will get copied. Register trademarks, patents, and design copyrights where applicable, and share new designs with factories on a need-to-know basis. Explore rotating or multi-sourcing critical product lines so no single supplier has a full picture

- Alternatively, brands can focus on building a few tight-knit, win-win partnerships underpinned by collaboration, knowledge-sharing and manufacturing innovation. Fostering long-term trust can reduce the likelihood of a manufacturer undercutting you. Consider co-developing proprietary materials, ingredients, formats or processes with your OEM while incorporating exclusivity or non-compete clauses

- Practice the ‘ingredient branding’, which turns an OEM relationship into a brand asset. If your product benefits from a high-quality supplier component, consider co-branding it to emphasise quality and create differentiation that purely copycat suppliers can’t claim. Take cues from outdoor apparel brands who proudly display Gore-Tex® labels to signal top-tier material

Fast Retailing’s Uniqlo has mastered the art of meaningful manufacturing partnership with its long-term relationship with Toray Industries. Together, they have created unique fabric innovations such as HeatTech, Airism and PuffTech, giving Uniqlo exclusive products and giving Toray a vested interest in the brand’s success

In action

London-based beauty brand Beauty Pie openly sources from the same laboratories as top luxury brands, utilising their OEM’s reputation to validate its products

Nike famously collaborates with its East Asian suppliers to pioneer new manufacturing and material technologies. Most recently, the brand worked with its Taiwanese factory to develop the brand’s latest apparel innovation, Forward

In fashion and the outdoors, many footwear brands such as Merrell and Arc’teryx already tout Vibram® soles or YKK zippers as marks of quality and durability

Brand strategy: craft and commit to your niche

When anything and everything can be replicated and sold on the internet, brands must zero in on what truly sets them apart. Focus on carving out a niche that suppliers cannot easily replicate – and build a universe of meaning around it.

Strategies

- Zero in on owning a specific category or aesthetic, and identify the product category or style where your brand can be the unequivocal leader. This could mean designing with a distinctive aesthetic, championing a particular material, solving a specific problem or serving a niche subculture

- Ramp up investment in world-building with experiences and content underpinned by tangible and emotioneered moments that can only be felt and lived, not bought

- As materialism shifts towards high-impact visibility, continuously innovate in retail and design to form a cultural halo around your brand, build iconicism into your products and capitalise on the Veblen effect (demand increases as price increases). Expand investment into well-curated limited-edition lines, artist and creative collaborations, and rapid product drops to keep your offerings fresh. Additionally, focus on bespoke and made-to-order production and in-store customisations to create offerings that mass suppliers can’t mimic

- Lean into the resurgence of artisanal products and local identities and markers as a point of differentiation from anonymous mass production. Leverage provenance as a status symbol and spotlight artisanal aspects or region-specific ‘Made in ____’ capsule lines. New Balance, for example, boasts premium ‘made in USA’ and ‘made in UK’ ranges

Brands like Arc’teryx (Canada) and Snow Peak (Japan) have become integral to outdoor culture by blending community, equipment and lifestyle into scalable ecosystems. Snow Peak, for example, announced the opening of Mount Akagi Land Station Campsite in Japan in 2026, featuring a tourist centre and gear store

In Action

Nike boasts a prolific pipeline of artist and athlete collaborations, co-branded event merchandise and frequent sneaker drops, ensuring that it stays ahead, and that dupe manufacturers are always chasing last season. In February 2025, for example, the brand teamed up with fashion brand Skims for a female-focused range of inclusive and innovative activewear

From community-led activations to a commitment to body inclusivity, see our Brand Case Study: Gymshark to explore the winning strategies that have helped this British activewear brand find global success

Amid the niche sports boom, Hong Kong-based streetwear brand Bolder Boiz takes a community-led approach to product design, putting shared interest in the city’s bouldering scene front and centre. Designer Caius Man invites creative input from fellow climbers, transforming in-jokes and catchphrases into placement prints.

Billed as a “tableware universe” rooted in artisanal craftsmanship, New York City-based interiors brand Gohar World differentiates itself with a commitment to disappearing craft traditions and producing products in family ateliers around the world

Supplier strategy: start selling on socials

Strive to be your own middleman to win a greater share of the profits and protect bottom lines amid short-term uncertainty. Show, don’t tell, and be prepared to adjust your approach rapidly based on feedback.

Strategies

- Tap straight into consumer curiosity and deal-hunting instincts with behind-the-scenes content that helps humanise your factory and undercuts the mystique and mark-up of Western brands. This could include time-lapses of an item being made, makers assembling products, or a comparison of your item vs a pricey brand version

- Prioritise building trust with consumers who may be wary of ordering directly from overseas. Pre-empt common concerns around shipping times, return policies and quality assurances. Communicate any certifications you meet, engage with customer comments promptly and respond to queries with proof points

- Be truthful (don’t claim false affiliations), and use this moment to redefine what value means. Override the image of ‘cheap’ by showcasing the quality and reliability of your offerings

- Be aware of regional variations around livestream selling as you go global from APAC, and develop locally relevant creator partnerships and affiliate programmes to extend reach fast. See our global series on livestream selling, which covers China, Southeast Asia, India and the US, EU and LATAM

- Stay experimental with content, including interactive demos, factory walkaround live videos and Q&As, and conduct A/B testing across different platforms and content formats to find what works best with your audience. Monitor metrics and be ready to pivot resources to the channels that yield click-through/actual conversion

On TikTok, creators such as @wlasrey (479.9k followers), @lcsign_signfactory (1.1m followers) and @lunasourcingchina (1.2m followers) are finding fame by giving viewers a rare peek into fashion manufacturing with factory tours and transparent information about sourcing and production

In Action

Tapping into repetitive content that offers chaos as comfort on livestreams, Singaporean TikTok-based candy seller, Candy Cottage, streams staff packing candy orders on live every Sunday to Thursday

Chinese shopping app DHGate runs the DHGate Affiliate Program, where participants, including creators such as American Tiktoker @elizabethhenzie (13.3k followers) and YouTuber @CraftyGirl (238k subscribers), receive free products for review and earn commission on their product recommendations

While e-commerce platform Temu’s early marketing focused purely on price-based deals, some up-and-coming Chinese DTC brands such as Tineco have found success highlighting tech specs and awards their products have won

Tapping into repetitive content that offers chaos as comfort on livestreams, Singaporean TikTok-based candy seller, Candy Cottage, streams staff packing candy orders on live every Sunday to Thursday

Supplier strategy: reframe ‘made in Asia’

For Asian manufacturers, who have long been the workhorses behind global goods, it’s time to redefine what ‘Made in Asia’ means. Position it as a badge of quality and innovation beyond simple cost-saving.

Strategies

- Showcase Asia’s world-class manufacturing prowess with short videos that highlight state-of-the-art robotics, skilled craftsmanship and rigorous standards. This will both challenge perceptions that Asia’s factories are simply cheaper, and sell the idea that buying direct means getting the newest and best, straight from the source of innovation

- Tackle quality concerns head-on and address this upfront in your marketing with testimonials from international customers. If your factory is audited for social compliance or if you provide good wages and conditions, work that into the narrative to underscore concerns around ethical manufacturing

- Where relevant, suppliers should leverage Asia’s artisanal heritage as a brand asset to reframe ‘Made in Asia’ from anonymous factory to cultural specificity. From Jingdezhen porcelain and Suzhou silk in China to Jaipur’s jewellery craftsmanship in India, anchoring goods in local excellence turns origin into a narrative of pride, knowledge and cultural intimacy

- Alternatively, lean into new specialisations, technologies and niches where Asia is dominating – for example: electric vehicles, solar panels and home tech from China or K-beauty ingredients and format innovations from Korea. Former OEMs like Anker and Tineco are already becoming global consumer brands increasingly associated with quality and innovation

- For manufacturers looking to build out DTC capabilities, ride the soft power surge from Asia to meet younger consumers globally who are more open-minded about global products. Pay attention to the new wave of Asian brands and designers gaining global acclaim to identify creative partners that help showcase your products as innovative and original designs with R&D behind them

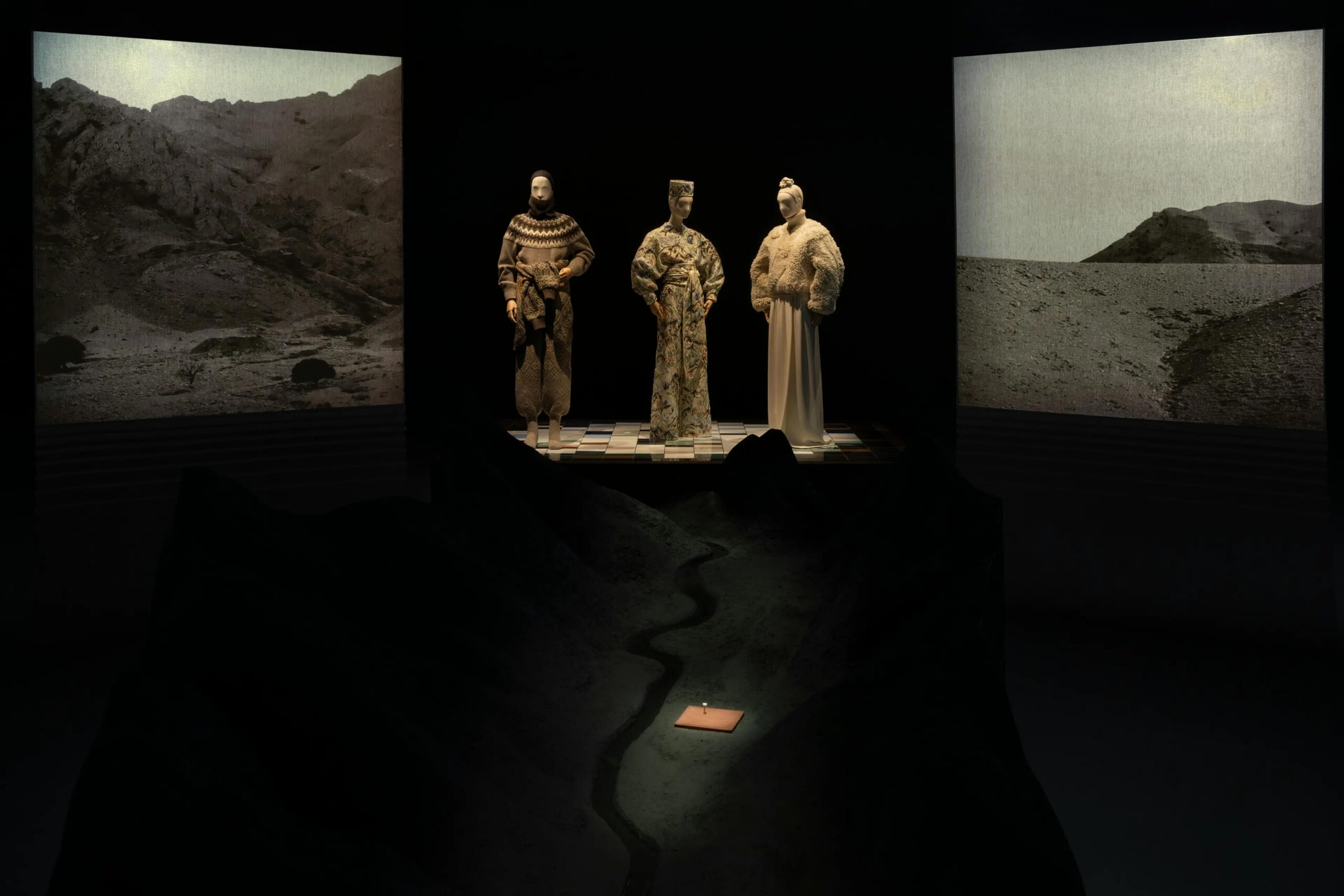

In luxury fashion, some forward-thinking brands openly acknowledge that their Asian partner factories and suppliers are among the best in the world at certain techniques or materials. Loro Piana, for example, showcased its deep relationship with crafts and cashmere in China at its first-ever exhibition, If You Know, You Know. Loro Piana’s Quest for Excellence, in Shanghai in March 2025

In Action

Korean beauty (K-beauty) brands such as Laneige (stocked in Sephora), Medicube and Fwee conquered the world not just with low prices, but by proudly pushing their ‘made in Korea’ innovations in skincare, leveraging South Korea’s reputation for hi-tech and beauty-forward expertise. Boots, Britain’s largest beauty retailer, sold a K-beauty skincare product almost every 15 seconds between December 2024 and February 2025

Boasting stockists including Mr Porter, Dover Street Market Ginza and Ssense, NYC- and Delhi-based fashion brand Kartik Research celebrates Indian craftsmanship and subcultural heritage, from the 1960s Indian Beat Generation to banana fibre weaving

In Singapore, Chinese EV automaker BYD topped new car sales in 2024 as consumers shed older, more negative perceptions of ‘made in China’ cars. It continued its streak into 2025, emerging as the best-selling car brand from January to April 2025

Supplier strategy: nurture trust with brands

Suppliers launching DTC (direct-to-consumer) offerings will effectively have to wear two hats – manufacturer and brand. Manage this dual identity carefully to avoid alienating BTB clients.

Strategies

- Be transparent and proactive to your BTB clients about your DTC plans and emphasise that your DTC line will not cannibalise their business. Do this by walling off and segmenting categories up front with brands to safeguard against potential cross-selling. Ensure a clear separation of design and IP, and develop unique product lines for your DTC venture that use different designers or a different aesthetic

- Prioritise capacity and quality for existing clients over your DTC initiatives, unless your business has decided to make a strategic shift towards DTC. Assure your clients (with data, if possible) that you’ve added extra staff or production lines specifically to manage the DTC demands, so their orders remain on schedule

- Maintain (or even tighten) your quality control for client batches, so there’s no perceptible drop in standards. As more suppliers go DTC, delivering business-as-usual (or better) to your brand partners, even as you scale consumer sales, will earn you a reputation as a reliable, professional partner

American retailer Walmart works with many suppliers who also sell directly on Walmart’s marketplace website. Instead of conflict, Walmart enables this and takes a cut of sales, in addition to charging for fulfilment and advertising services. Similarly, suppliers utilising the platform will have to ensure that they balance Walmart’s interests on top of their own

In Action

Chinese portable fan manufacturer JISULIFE has begun brand-building on its own while balancing new business via retail partners. It named Thai actor Billkin of How to Make Millions Before Grandma Dies as its first-ever brand ambassador in August 2024, and launched an activation at Coachella 2025

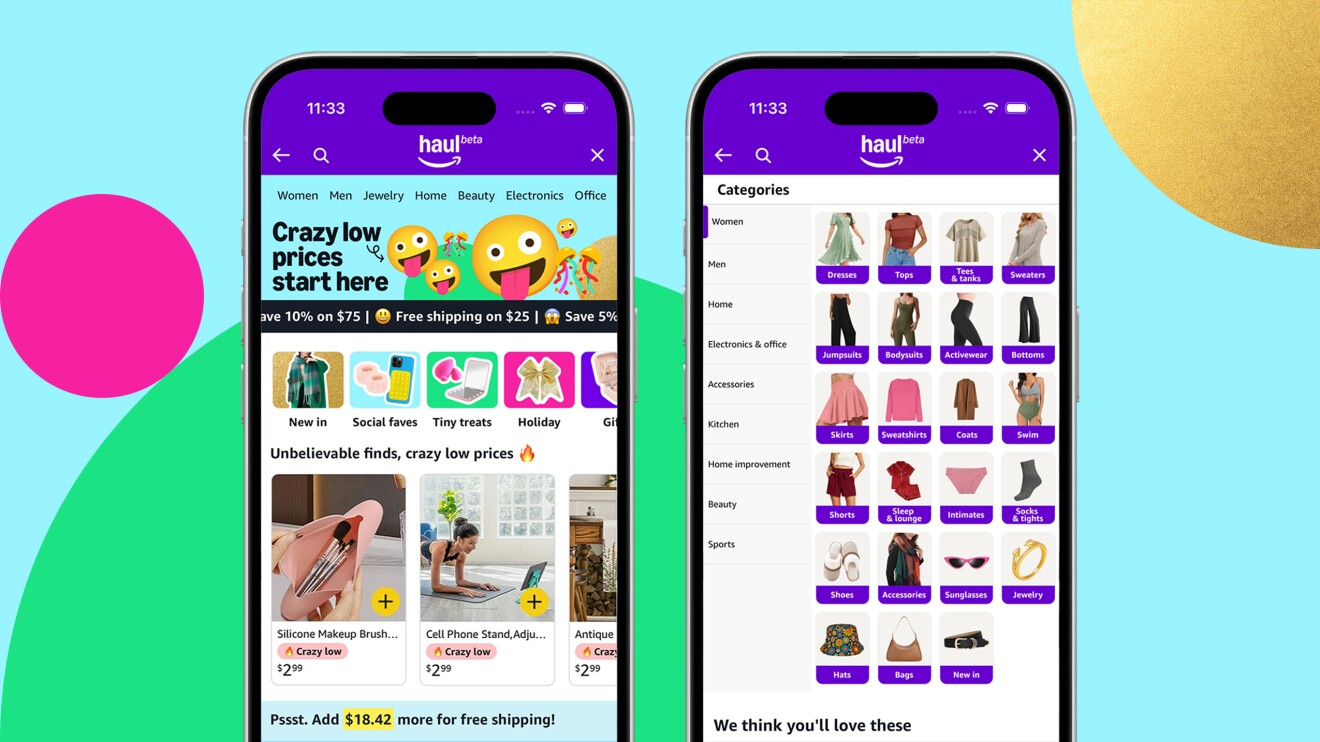

Amazon introduced Amazon Haul, a new section for shoppers to buy directly from sellers in China, in November 2024. Billed as a shopper experience “that brings lower-priced products into one convenient destination,” the platform marks new opportunities for suppliers to offload stock and build a DTC presence in global markets

Taiwanese DTC bicycle brand Giant Bicycles began as an OEM for major global brands like Schwinn and Trek before launching its own consumer brand in the 1980s. Today, it’s both a globally recognised DTC brand and a leading OEM, maintaining both roles by separating product lines and building trust with partners