APAC’s popular small-format and convenience stores offer opportunities for brands to drive growth and test new markets. Discover four strategies to maximise your impact amid a cautious shopper landscape

Alison Ho | 03.29.25 – 7 minutes

Need to know

Convenience stores are an indispensable and ubiquitous player in Asia’s retail fabric, and they offer winning strategies for businesses looking to expand small-format and affordable store networks amid a more cautious consumer landscape.

Opportunity

Brands and retailers that launch small-format stores and convenience store collaborations stand to win big with the new middle in Asia, where consumers are seeking out more value, affordability, speed and convenience. Small-format and convenience stores are especially popular in Southeast Asia and lower-tier cities in India and China, where distances between residential and commercial hubs can be far and traffic is congested. India’s INR82tn (approx $958bn) retail sector (Boston Consultancy Group, 2024) is dominated by some 13m kiranas (mom-and-pop or small businesses) which contribute over 10% of the country’s GDP (Deccan Herald, 2024). Meanwhile, in South Korea, convenience stores were the second most popular offline retail channel in H1 2024, winning 16% of the market (The Korea Times).

Today, local convenience stores have evolved beyond pure utility to emerge as vibrant cultural hubs and community ecosystems, offering new opportunities for brands via innovative product launches, cultural experiences and expanded distribution networks and services. The ongoing drive towards digital transformation, including data-driven inventory management, IoT systems and SuperApp integrations, along with the community-led ethos and hyper-localised offerings of convenience stores offer key lessons for brands and retailers looking to develop agile, culturally resonant and cost-efficient small-format stores across the region.

STEPIC forecasts: Glimmers, Life-Stage Design, Fresh Perspectives, Strategic Joy

Strategies

Elevate everyday essentials: transform the mundane into glimmer-filled cultural moments of joy to excite shoppers and incentivise spend

Facilitate urban grab-and-go culture: facilitate convenience and ease for shoppers via mobile-optimised journeys, tech-powered smart stores and formats and convenience stores as distribution partners

Ramp up on affordability and access: leverage the convenience stores to reach new segments and democratise new lifestyles

Adopt hyperlocal precision: tailor your offerings and services to the unique needs and contexts of local communities and neighbourhoods

Related industries: food and drink, beauty, entertainment, interiors and retail

Elevate everyday essentials

A key strategy in Asia Shopper Priorities 2025, brands and retailers must spark joy and build positive feelings into offerings to add emotional value and incentivise spending amid more cost-conscious shopper behaviours and sentiments.

Strategies

As younger Asian consumers increasingly spend on their favourite entertainment and media brands and allegiances, brands must world-build alongside fandoms and start developing co-branded products and experiences alongside entertainment companies, sports teams, new media personalities and franchises. Food and drink brands and convenience store chains, especially, should expand investment into feeding the fandom

Extend fandom partnerships by transforming stores into ‘collectible experiences’ and pop-ups to attract footfall and facilitate feelings of IRL serendipity

Be careful to avoid culture rot and ensure that you’re creating new influence and cultural impact as you generate hype via collaborations. This refers to the risk of creating regurgitated products and content that mindlessly chases the algorithm rather than meaningful cultural partnerships

Lean into the fascination with fun, delicious and unique convenience store combinations via innovative product bundles featuring unexpected flavour crossovers, viral pairings and complementary products

Capitalise on the cultural clout emerging behind Asia’s convenience store (‘combini’ or ‘kombini’) culture with collaborations in non-traditional product categories such as apparel and accessories. Japanese convenience chain FamilyMart, for example, is emerging as a bona fide brand with a clothing line named Convenience Wear and stationery collections

FamilyMart (Japan) teamed up with the organisers of the Fuji Rock Festival to launch exclusive concert apparel such as socks and sweat towels before the event in July 2024

In February 2025, FamilyMart (Japan) appointed Kenzo’s artistic director, founder of A Bathing Ape and streetwear icon Tomoaki Nagao, better known as Nigo, as Creative Director for the brand. Nigo will head up the chain’s visual identity, collaborative projects and new store initiatives

Appealing to K-wave fandoms, South Korean convenience store chains like CU and GS25 are stocking up on K-pop albums and merchandise as part of their product assortment. In March 2025, GS25 teamed up with female idol group NMIXX to launch MMU: Beyond The FIELD, a Seongsu-dong pop-up store featuring exclusive idol-themed snacks, photocards and albums

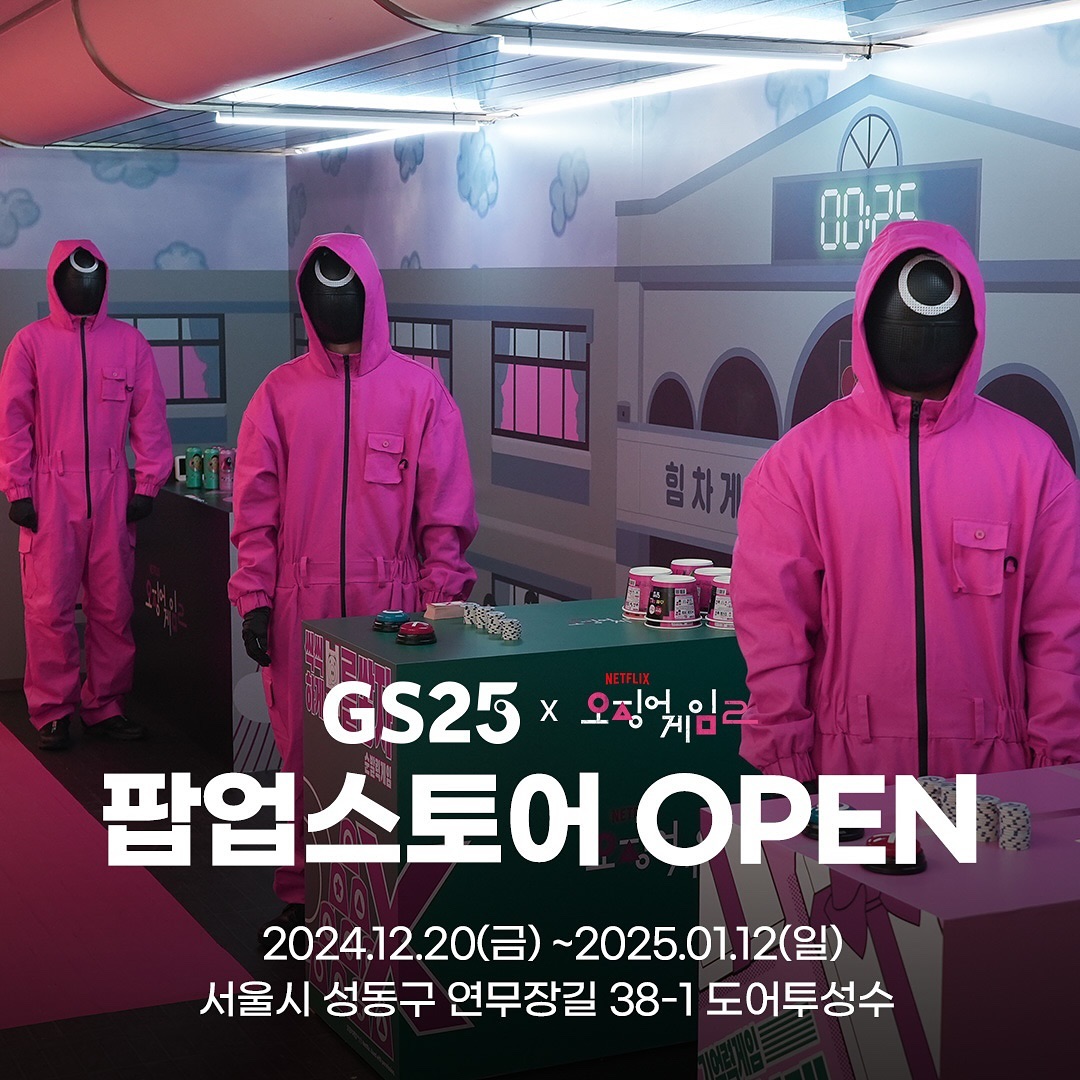

Coinciding with the launch of Netflix’s Squid Game: Season 2, South Korean convenience chain GS25 turned its Seongsu-dong location into an immersive playground with replica sets from the series. The chain also launched over 30 Squid Game-themed products, ranging from traditional Korean snacks to desserts and beverages

Facilitate urban grab-and-go culture

Supercharge Asia’s convenience culture by digitising operations, ramping up automated formats and offering round-the-clock service.

Strategies

Continue experimenting with frictionless grab-and-go formats. Ensure that you’re also deterring thefts and other damaging behaviours by charging initial deposits for shoppers who use these services

Implement mobile ordering with in-store pickup options to reduce wait times. Work with local super apps such as Grab, WhatsApp and WeChat to create in-platform hubs that do not require shoppers to download and set up a new app

Cater to commuters. Explore and expand into instant retail channels such as smart vending machines, especially in high-traffic commuter locations and around peak hours

Beat the growing labour crunch, especially in ageing markets like Japan, by experimenting with remote support services to offer help to shoppers 24/7

Work with convenience store chains to create a convenient, extensive and cost-efficient last-mile distribution network for your brand. Billed as “India’s neighbourhood shopping app,” KiranaPro’s platform facilitates ultra-fast deliveries from local kiranas (small stores, usually family-owned) and supermarkets

South Korean retailer MUSINSA has partnered with local convenience store chain GS25 to introduce fashion essentials from its private label, MUSINSA STANDARD, at over 3,000 GS25 locations nationwide. This also helps the convenience chain to expand its non-food offerings

Japanese e-commerce platform Mecari is facilitating cross-border transactions in Taiwan via convenience store chain 7-Eleven, whose 7,000-store strong network acts as a pick-up hub for shoppers. Over 50,000 user registrations were recorded in the first month of launch (Mecari, 2024)

In January 2025, Japanese convenience chain Lawson launched cashiers fronted by avatar clerks to virtually man the overnight shift, which were operated by Japanese people living abroad where they could work more regular business hours

In January 2025, Japanese convenience chain Lawson launched cashiers fronted by avatar clerks to virtually man the overnight shift, which were operated by Japanese people living abroad where they could work more regular business hours

Coca-Cola launched Coke&Go, its new QR code and mobile-powered smart coolers, in partnership with Southeast Asian super app Grab in September 2024. The coolers, strategically placed in high-footfall areas, can be unlocked by scanning a QR code using the Grab app. After grabbing a drink and closing the fridge, customers can view product details and pricing on the app before making payments. Products are accounted for via image recognition. Coke&Go trials were extended to Sydney in December 2024

Ramp up on affordability and access

Tap on the extensive reach of local, family-owned stores and convenience chains to bring your products to the masses fast and democratise access to new codes of aspiration, especially around wellness and longevity.

Strategies

Explore takeaway kiosks and smaller store formats that stock affordable ranges in high-traffic or lower-tier city locations where there isn’t enough demand to support full-size stores. Decathlon Connect concepts in India, for example, are smaller stores with limited ranges

Premium CPG brands can start testing demand and building brand awareness with newer segments in emerging Tier 2 and 3 cities by exploring convenience chains and local mom-and-pop stores as new distribution networks, and by working with convenience store conglomerates to create affordable ranges. JioMart in India has digitised over 30,000 kiranas in a bid to scale reach and operations

Downsize regular products or curate cost-saving bundle deals to democratise access to micro-moments of luxury and indulgence for consumers

Expand touchpoints as well as healthy eating and soft wellness food and drink assortments to meet emerging lifestyle priorities around holistic wellness and democratise longevity for the masses. Wellness desserts, snackable supplements and functional beverages and snacks will be key categories for brands and retailers to explore

Continue to make inroads into sustainable store strategies, especially around minimising plastic use and waste and encouraging conscious consumption choices. Introduce visual cues that nudge consumers toward sustainable decisions

In October 2024, GS25 expanded its lineup of affordable and small-pack beauty and skincare basics in collaboration with local K-beauty brands Isntree, Scinic and Mediheal. The initiative aimed to increase spending among Gen Z and Alpha consumers, who typically shop for basic beauty products at convenience stores

FamilyMart (Japan) launched an all-vegan menu, Blue Menu, in December 2024, comprising grab-and-go meals, snacks and a dessert

In October 2024, FamilyMart (Japan) started experimenting with cute teary-eyed stickers containing a “please help me” plea on near-expiration onigiris, sandwiches and bento boxes in a bid to prevent food waste

One of Japan’s most reputable ramen chains, Tenkaippin, teamed up with convenience store chain Lawson to create an affordable and microwaveable version of its classic Kotteri Ramen and other popular items in 2024

Chinese coffee chain Cotti Coffee is expanding its reach with branded kiosks at over 50 retail partners’ stores, including high-street retailers, F&B and convenience store chains such as Meiyijia, Lawson, Wallace Food and Home Inn

Adopt hyperlocal precision

As consumers increasingly turn to nearby stores for their daily essentials, retailers can offer products and services that put local communities’ needs and preferences front and centre.

Strategies

Customise offerings for each location. Introduce grocery deals, products and take-home meals in residential estates. In commercial districts, offer more work-friendly assortments such as premium food-to-go options, energy-boosting drinks and supplements or snacks

Create feedback loops and opportunities for co-creation alongside your local community, especially around bundle deals and expanded grocery and household assortments such as fresh produce, toiletries, laundry and cleaning equipment

Complement this by leveraging AI to forecast demand and practise dynamic pricing

Beyond taking a community-led ethos to craft neighbourhood dwelling spaces via cafe and bistro extensions and IRL entertainment hubs, retailers must also start considering how they can service new population demographics, especially migrant communities in ageing Asian economies like Japan, South Korea and Taiwan

Invest in right-sizing assortments that cater to newer living arrangements, especially solo households, DINKs (dual income no kids) and DINKWADs (dual income, no kids, with a dog), in neighbourhoods with younger consumers

In May 2024, Swedish furniture brand IKEA started testing smaller Plan and Order point stores, which are one-tenth of the size of its traditional stores, to offer personal consultations around complex order planning in Xi’an and Shenzhen. Shoppers can opt for home delivery or collection at a nearby store after completing the order

In 2024, FamilyMart teamed up with local NGO One-Forty to introduce multilingual signage, product labels and Southeast Asian product assortments at its stores across Taiwan as part of efforts to make services more friendly for the growing Southeast Asian migrant population

In a bid to attract tourists and younger shoppers, 7-Eleven added K-beauty products from brands such as ma:nyo, Mediheal and Cell Fusion C, alongside streetwear apparel from local brand Mwoong, to its DunDun shopping mall branch next to the Dongdaemun Design Plaza (DDP) in Seoul

BP revamped its Caboolture North service station in Australia to cater to local truck drivers in October 2024. Amenities include an enhanced truck drivers’ lounge, showers, laundry facilities, entertainment, food and drink offerings and a cafe extension

Yum China, the operator of fast-food brands such as KFC and Pizza Hut, is set to extend its presence in lower-tier Chinese cities with low-cost ‘small town mini-stores’ that offer ‘local taste’ products such as beef wraps with spicy duck blood and chicken and bullfrog tacos

Indonesian convenience chain K3mart is harnessing the local community by hosting events such as K-pop karaoke sessions and World Cup watch parties at selected locations across the nation